Investing in the US Market: A Guide to iShares Core S&P 500 ETF (IVV)

Table of Contents

- IVV – My Italian Friends

- IVV ETF, S&P500 지수추종 ETF

- Compare IVV vs. IVE | Which One is Better?

- IVV iShares S&P 500 ETF - 15:1 stock split : r/AusFinance

- Should you invest in iShares S&P 500 ETF (ASX:IVV)?

- Detail akcie ISHARES CORE S&P 500 ETF online - Patria.cz

- 미국 S&P 500 ETF IVV 주가 배당금 알아보기 : 네이버 블로그

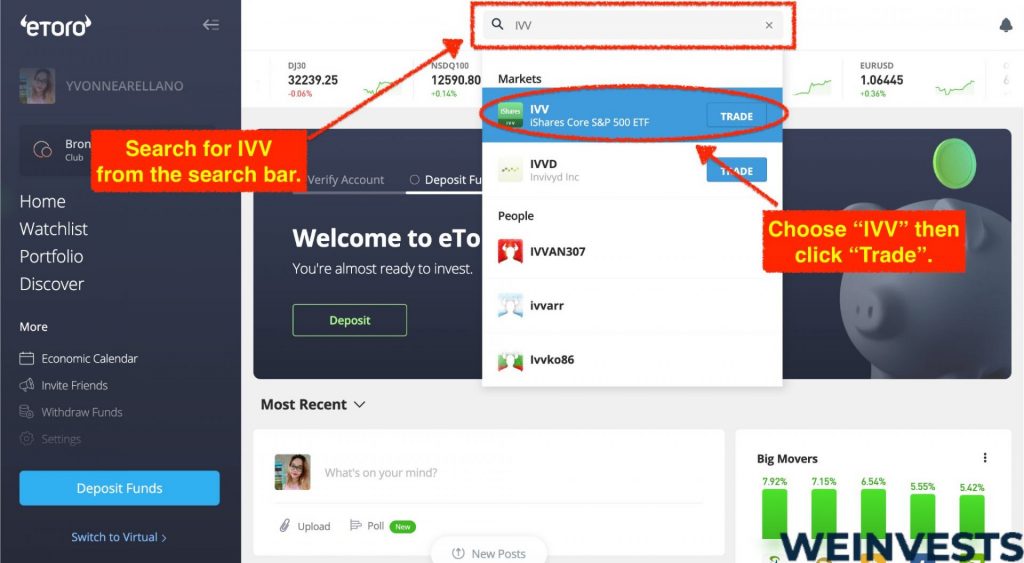

- iShares Core S&P 500 ETF (IVV) - WeInvests

- IVV – Brennan O’Neill Representatives

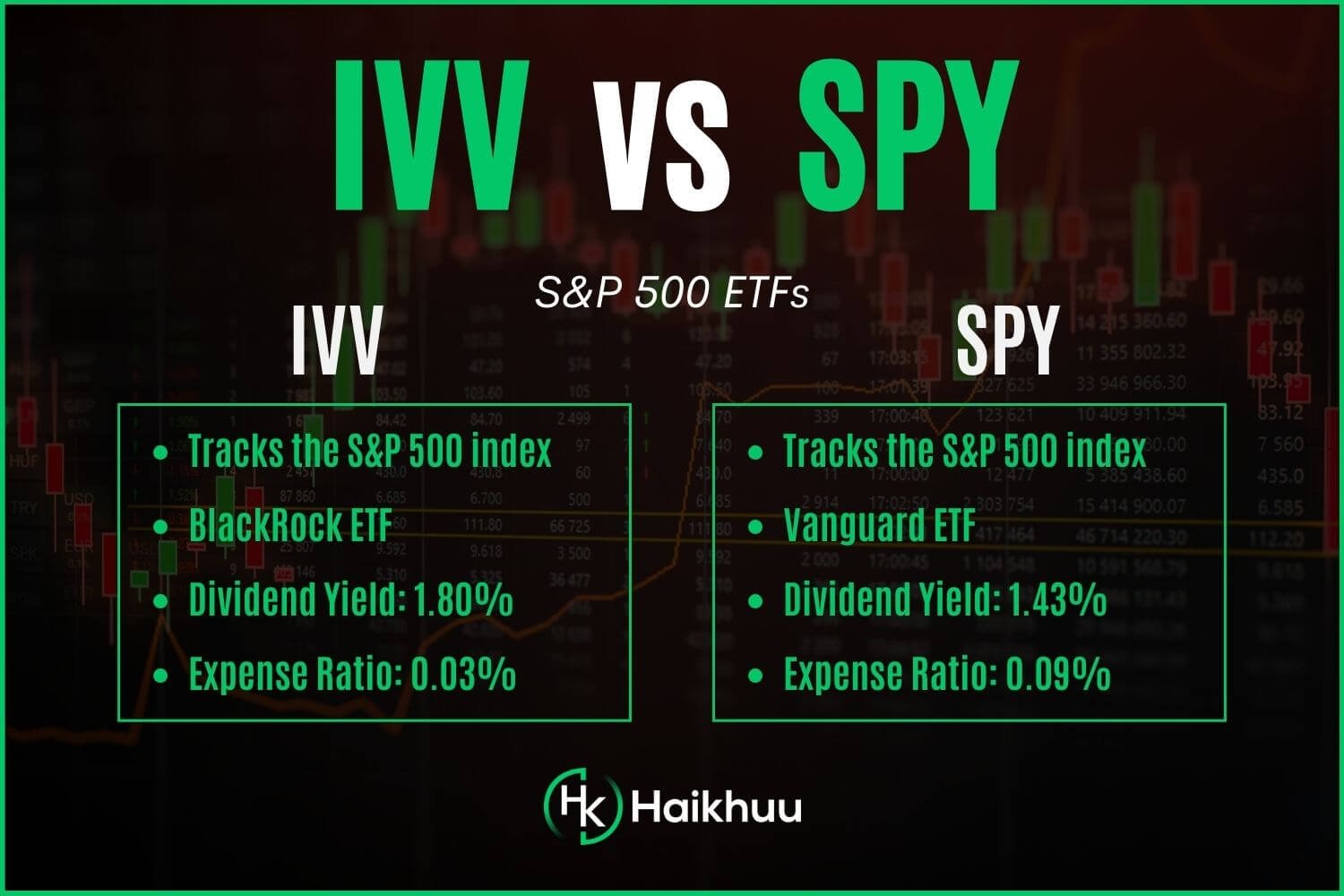

- SPY vs. IVV: Which is Best For You — HaiKhuu Trading

What is the iShares Core S&P 500 ETF (IVV)?

Benefits of Investing in the iShares Core S&P 500 ETF (IVV)

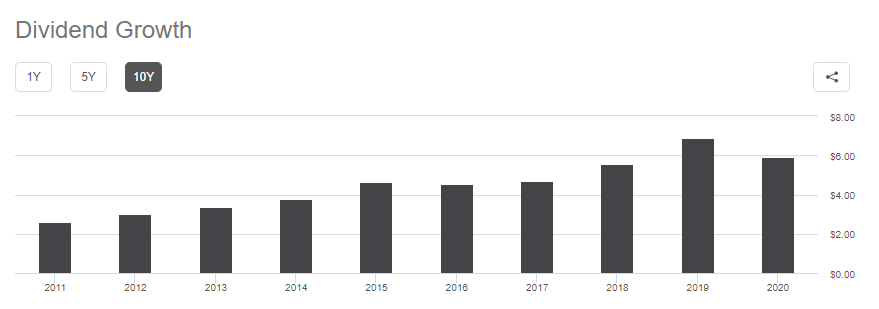

Risks and Performance

As with any investment, there are risks associated with investing in the iShares Core S&P 500 ETF (IVV). The fund's performance is closely tied to the performance of the S&P 500 index, which can be affected by a range of factors, including economic conditions, interest rates, and geopolitical events. However, the IVV has a long history of strong performance, with a 10-year average annual return of over 13%. The iShares Core S&P 500 ETF (IVV) is a popular and cost-effective way to invest in the US stock market. With its diversified portfolio, low costs, and flexibility, the IVV is an attractive option for investors looking to gain exposure to the US market. While there are risks associated with investing in the IVV, its long history of strong performance makes it a solid choice for investors looking to build a diversified portfolio.For more information on the iShares Core S&P 500 ETF (IVV), including its current price, performance, and holdings, visit the iShares website. Additionally, you can check the latest news and updates on the US News website.

Note: This article is for informational purposes only and should not be considered as investment advice. It's always recommended to consult with a financial advisor before making any investment decisions.